Jan 1, 1970

•

15 minute read

In Chile, the cost of electricity for businesses was long perceived as a given. Companies included it in their cost structure, assuming that tariffs were regulated and predictable. But with the end of the frozen-price period in 2024, the situation changed: tariffs began to rise, and this trend will continue in the coming years.

Today, managing energy consumption is not just a matter of saving money — it is a tool for protecting profitability and competitiveness. More and more companies are switching to solar energy to lock in their energy costs and reduce dependency on the market. However, there are different ways to implement this strategy, and the chosen model determines the financial outcome.

How Companies Started Saving Without Capital Expenditures

Traditionally, installing a solar plant required significant investment: purchasing panels, construction, insurance, and maintenance. The payback period stretched over 8–12 years, while the risks remained with the company.

Today, this model is being replaced by the Power Purchase Agreement (PPA) — a contract for the supply of solar energy at a fixed price. The company receives electricity from its own solar plant without paying for equipment: all expenses and maintenance are covered by the operator. The client pays only for the kilowatt-hours consumed — usually 10–15% cheaper than the current grid tariff.

This is how Partnergy operates — a solar plant operator in Chile. It handles design, installation, maintenance, and insurance, while the client receives turnkey solar energy for ten years at an unchanging price.

The key difference from traditional schemes: savings start immediately, not years later after the system pays for itself. For companies in tariff categories BT-3 and BT-4, where variable and peak charges make up a large share of costs, the effect is especially noticeable — a fixed rate directly reduces the cost of production.

How Rising Tariffs Turn Into Lost Profit

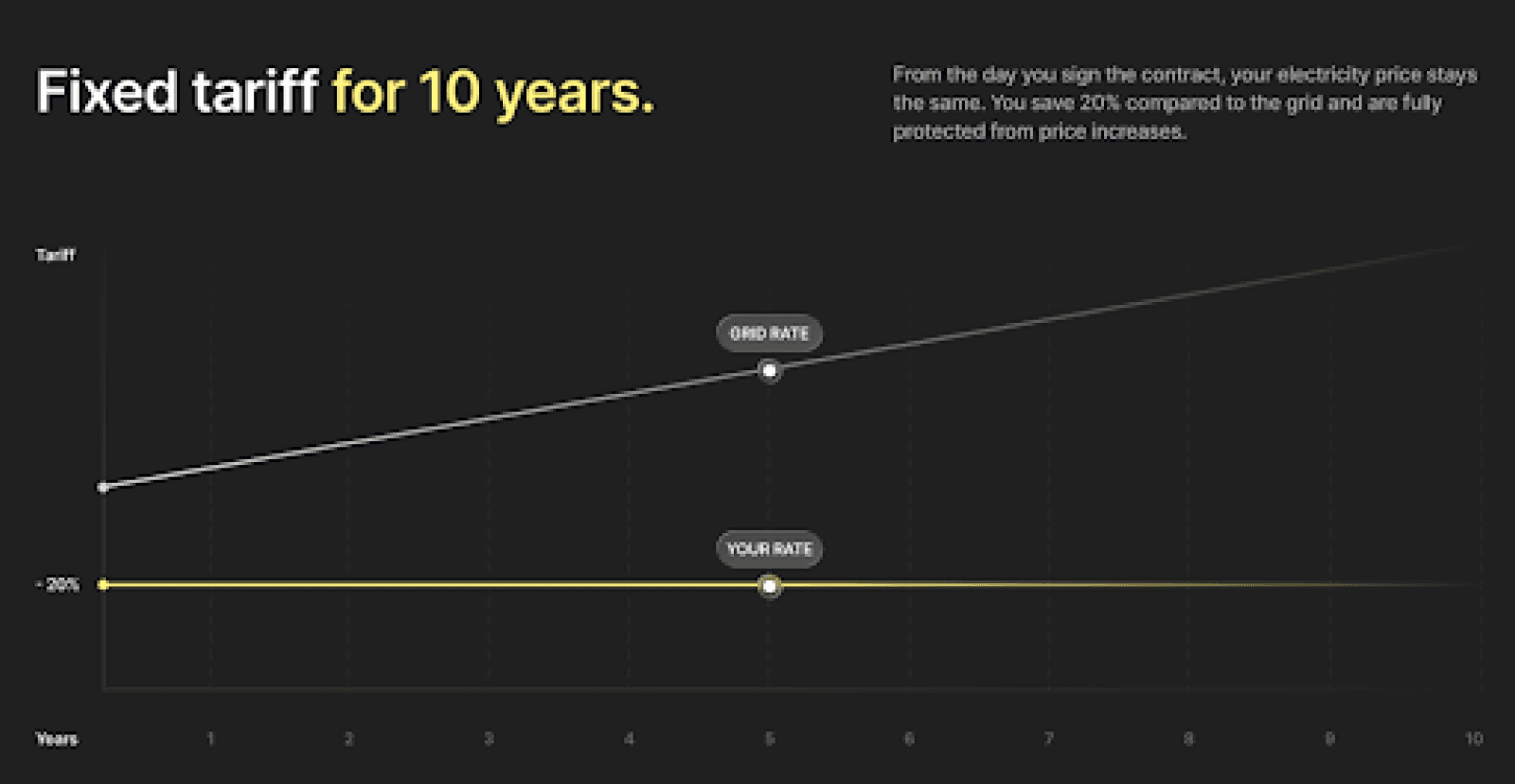

A 5% annual tariff increase may seem insignificant, but over ten years it results in 58% additional expenses.

If a company pays 100,000 CLP per month today, the total over 10 years will reach 15.2 million CLP.

With a fixed Partnergy price (20% below the current rate), total costs amount to 9.6 million CLP — a savings of nearly 5.6 million CLP, or 37%. The gap between controlled and uncontrolled expenses becomes a matter of strategy, not just accounting.

Why Owning a Solar Plant Isn’t Always the Best Option

For companies seeking long-term energy independence, building their own solar plant may appear to be an attractive solution.

However, it requires significant capital: the average project in Chile costs about USD 200,000 (≈ 190 million CLP) and takes 8–12 years to pay off. During this entire period, the capital is frozen, while the company bears maintenance costs and technical risks: declining panel efficiency, inverter failures, and regulatory updates.

If the same USD 200,000 is invested in the core business with a net profit rate of 20% annually, after ten years the capital would grow to USD 1.24 million.

Savings from owning a solar plant over the same period amount to approximately USD 300,000–400,000.

In the end, the return on investment in generation is 2–3 times lower than investing in operational growth.

Three Scenarios: Financial Simulation

Comparing the three approaches — continue paying rising tariffs, build your own plant, or choose Partnergy — the financial picture looks like this:

Indicator | Rising Tariffs | Own Solar Plant | Partnergy |

|---|---|---|---|

Capital Investment | 0 | 200,000 USD | 0 |

Total Cost | 15.2 million CLP | 11.5 million CLP (equiv.) | 9.6 million CLP |

Savings vs. Baseline | — | ~24% | ~37% |

Time to Launch | — | 6–12 months | 30 days |

Operational Risks | High | Medium | Zero |

Energy as a Managed Profit Factor

For businesses — especially small and medium-sized ones — energy is no longer just an expense line. It becomes a controllable asset that impacts margin, budget predictability, and overall resilience.

Switching to solar energy under the Partnergy model is not just a step toward a “green image.” It is a financial planning tool: a fixed ten-year rate turns volatile expenses into a stable, predictable cost.

In an environment of rising tariffs, inflation, and pressure on margins, this approach becomes part of a broader strategy for survival and growth.

Calculate Your Savings Now

It takes less than a minute. All you need is the amount from your latest electricity bill.